Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates.

How Equity Has Grown in Recent Years

Because of the imbalance between how many homes were for sale and the number of homebuyers in the market over the past few years, home prices appreciated substantially.

And while price appreciation has slowed this year, that doesn’t mean you’ve lost all the equity in your home. In fact, the latest Homeowner Equity Insights report from CoreLogic finds the average homeowner’s equity has grown by $34,300 over the past year alone.

And if you’ve been in your home longer than that, chances are you have even more equity than you realize.

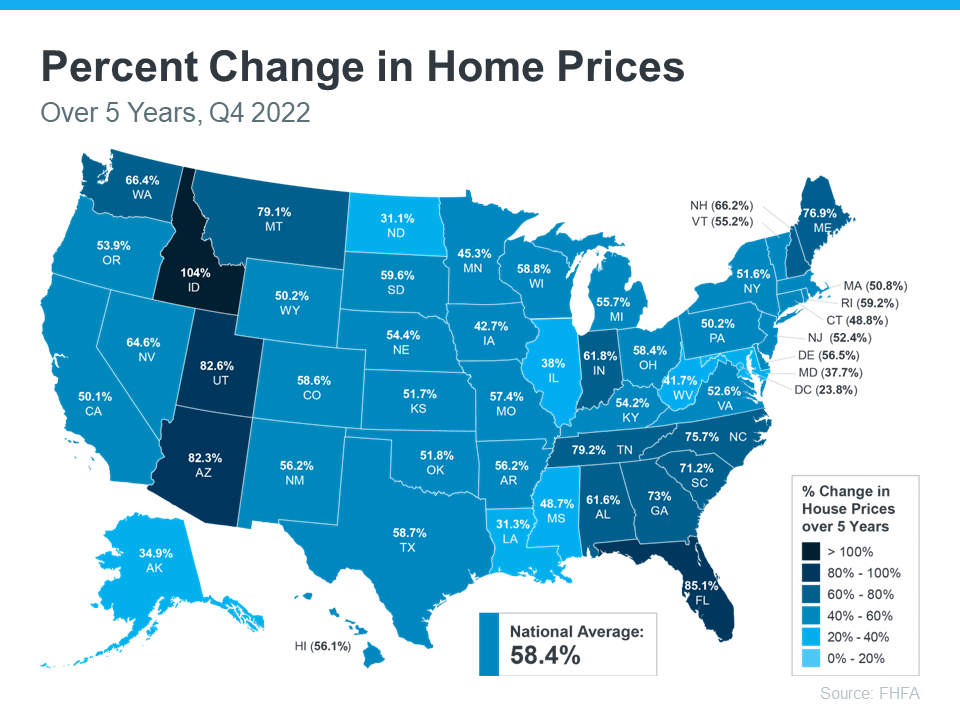

While that’s the national number, if you want to know what happened in your area, look at the map below from the Federal Housing Finance Agency (FHFA). It shows on average how much home prices have risen over the past five years, which has been a major driver behind equity growth.

Why This Is So Important Right Now

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you’ve built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling, it may be time to find out how much equity you have and how it can help fuel your next move.

One Major Benefit of Investing in a Home

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional.

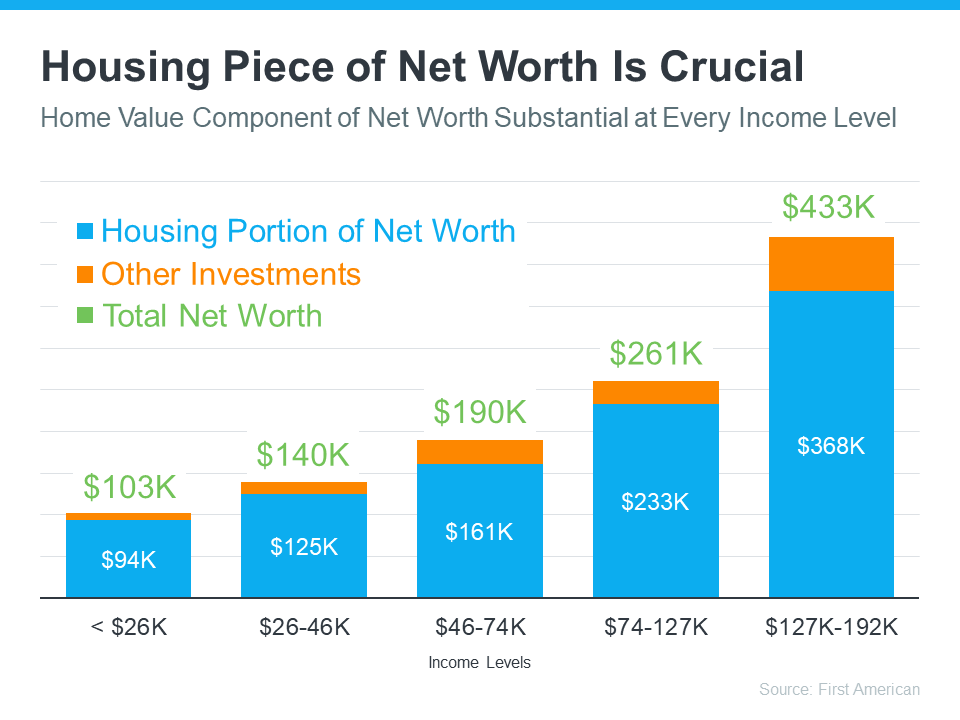

The Largest Part of Most Homeowners’ Net Worth Is Their Equity

You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares:

“Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.”

In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below):

Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect today so you can start investing in homeownership.