If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. If we take a year-over-year view, home prices did drop some, but that’s because we’re comparing to a ‘unicorn’ year when prices peaked well beyond the norm.

To avoid an unfair comparison to that previous peak, we need to look at monthly data. And that tells a very different and much more positive story. While local home price trends still vary by market, here’s what the national data tells us.

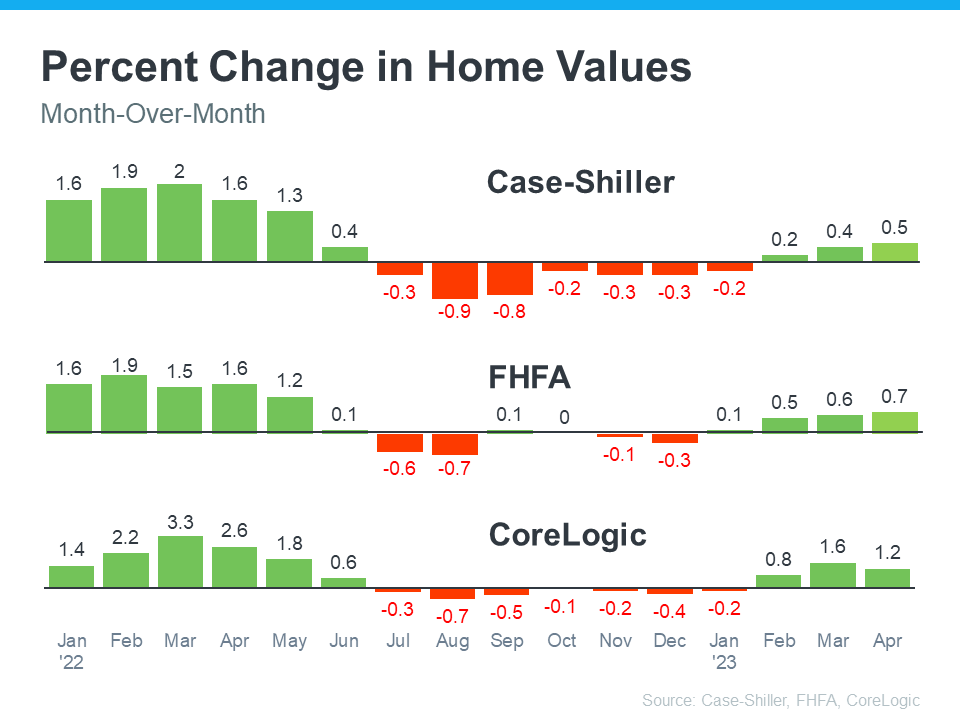

The graphs below use recent monthly reports from three sources to show the worst home price declines are already behind us, and prices are appreciating nationally.

Looking at this monthly view, we can see the past year in the housing market can be divided into two parts. In the first half of 2022, home prices were going up, and fast. However, starting in July, prices began to go down (shown in red in the graphs above). By around August or September, the trend started to stabilize. But, looking at the most recent data for early 2023, these graphs also show that prices are going up again.

The fact that all three reports show prices have been going up for three or more straight months is an encouraging sign for the housing market. The month-over-month data indicates a national shift is happening – home prices are rising again.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, says this about home price trends:

“If I were trying to make a case that the decline in home prices that began in June 2022 had definitively ended in January 2023, April’s data would bolster my argument.”

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them. Even with today’s mortgage rates, there are more people looking to buy than there are homes available for sale.

Mark Fleming, Chief Economist at First American, explains how more demand than supply keeps upward pressure on prices:

“History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices."

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, states home price growth is exceeding expectations thanks to that high demand:

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

Here’s How This Affects You

- Buyers: If you've been holding off on buying because you were worried the value of your home would go down, knowing home prices have bounced back should bring you some relief. It also gives you the opportunity to own something that usually becomes more valuable as time goes on. Buying now lets you make your move before home prices climb more and gives you the chance to own an asset that typically grows in value over time.

- Sellers: If you've been waiting to sell your house because you were concerned about how changing home prices would affect its value, it may be time to jump back in and partner with an agent to list your house. You don't have to wait any longer because the latest data suggests things are turning in your favor.

Bottom Line

If you put off your plans to move because you were worried about home prices falling, , the latest data shows the worst is already behind us, the worst is already over and prices are actually appreciating nationally. Let's get in touch so you know what's happening with home prices in our area.

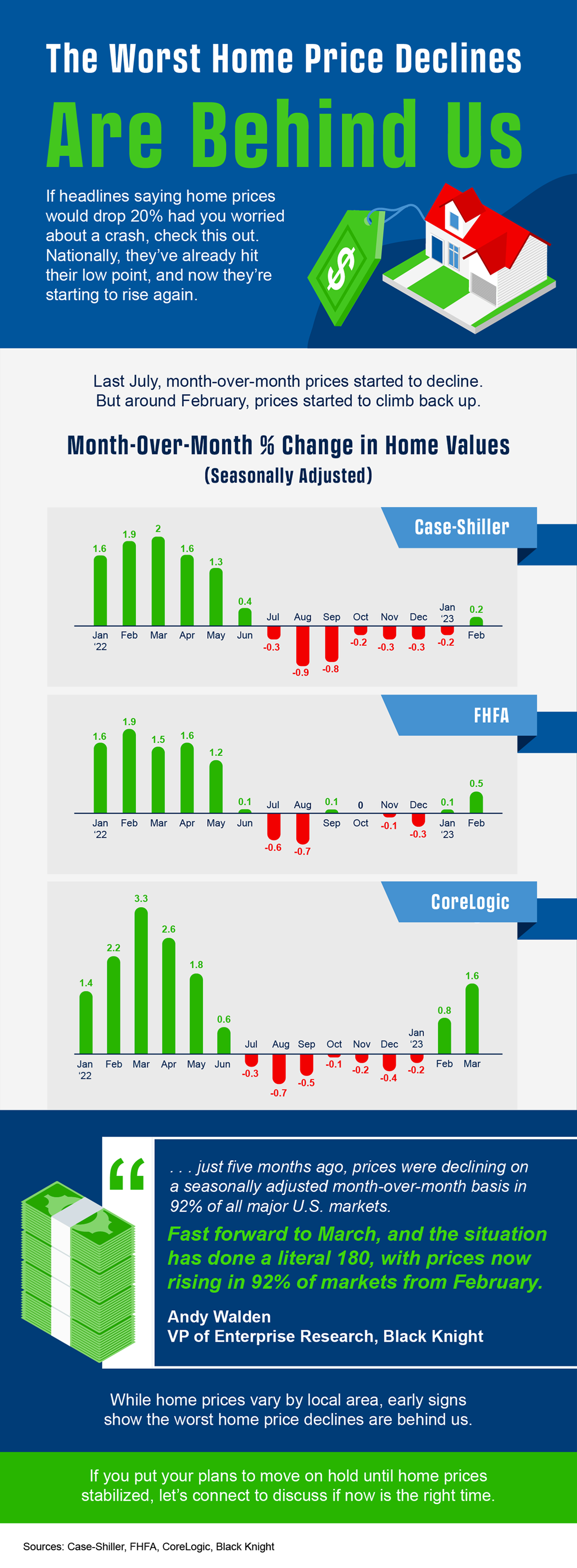

Some Highlights

- While home prices vary by local area, they’ve already hit their low point nationally, and now they’re starting to rise again.

- Last July, prices started to decline, but around February, they began climbing back up.

- If you put your plans to move on hold waiting to see what would happen with home prices, let’s connect to discuss if now’s the right time to jump back in.

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here's an explanation of each.

Year-over-Year (Y-O-Y):

- This comparison measures the change in home prices from the same month or quarter in the previous year. For example, if you're comparing Y-O-Y home prices for April 2023, you would compare them to the home prices for April 2022.

- Y-O-Y comparisons focus on changes over a one-year period, providing a more comprehensive view of long-term trends. They are usually useful for evaluating annual growth rates and determining if the market is generally appreciating or depreciating.

Month-over-Month (M-O-M):

- This comparison measures the change in home prices from one month to the next. For instance, if you're comparing M-O-M home prices for April 2023, you would compare them to the home prices for March 2023.

- Meanwhile, M-O-M comparisons analyze changes within a single month, giving a more immediate snapshot of short-term movements and price fluctuations. They are often used to track immediate shifts in demand and supply, seasonal trends, or the impact of specific events on the housing market.

The key difference between Y-O-Y and M-O-M comparisons lies in the time frame being assessed. Both approaches have their own merits and serve different purposes depending on the specific analysis required.

Why Is This Distinction So Important Right Now?

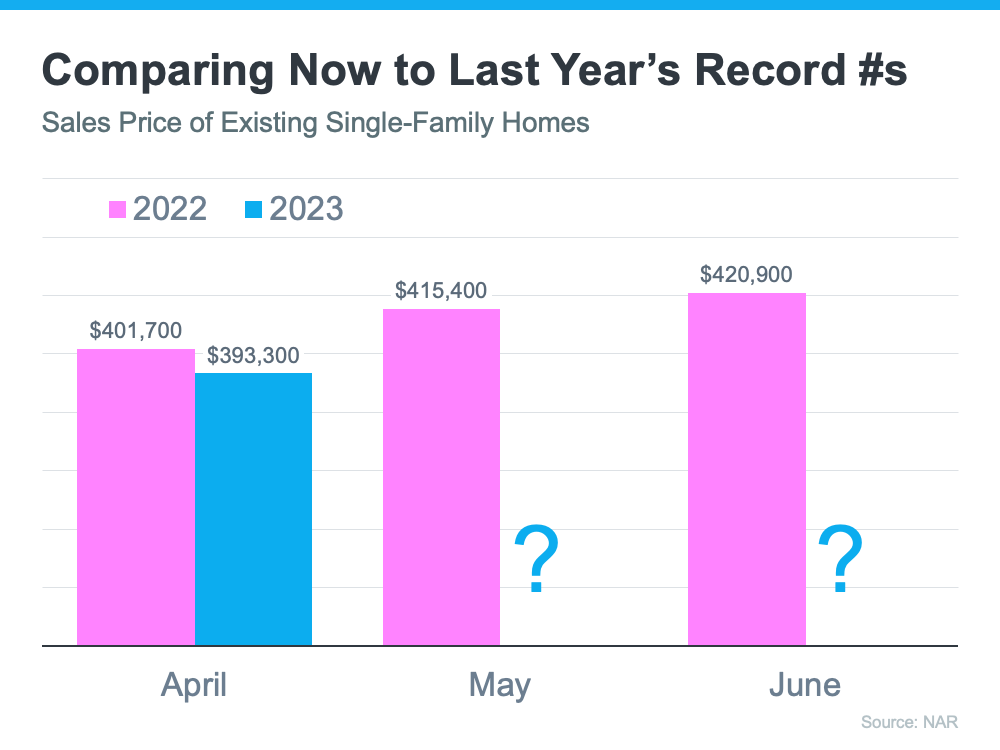

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year. April, May, and June of 2022 were three of the best months for home prices in the history of the American housing market. Those same months this year might not measure up. That means, the Y-O-Y comparison will probably show values are depreciating. The numbers for April seem to suggest that’s what we’ll see in the months ahead (see graph below):

That’ll generate troubling headlines that say home values are falling. That’ll be accurate on a Y-O-Y basis. And, those headlines will lead many consumers to believe that home values are currently cascading downward.

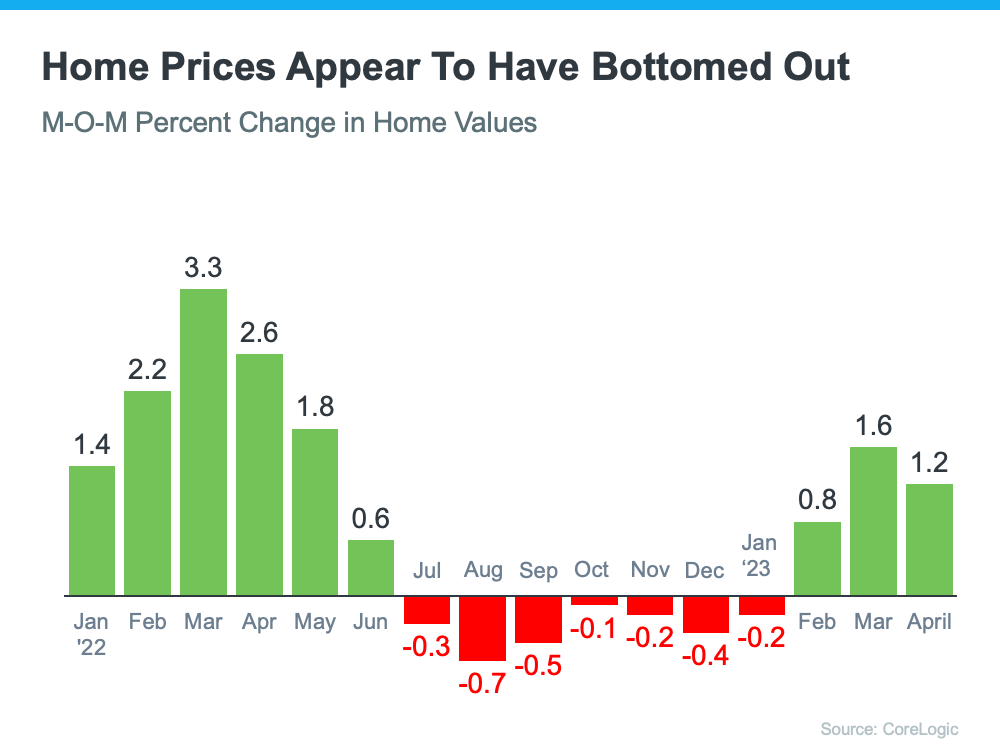

However, on a closer look at M-O-M home prices, we can see prices have actually been appreciating for the last several months. Those M-O-M numbers more accurately reflect what’s truly happening with home values: after several months of depreciation, it appears we’ve hit bottom and are bouncing back.

Here’s an example of M-O-M home price movements for the last 16 months from the CoreLogic Home Price Insights report (see graph below):

Why Does This Matter to You?

So, if you’re hearing negative headlines about home prices, remember they may not be painting the full picture. For the next few months, we’ll be comparing prices to last year’s record peak, and that may make the Y-O-Y comparison feel more negative. But, if we look at the more immediate, M-O-M trends, we can see home prices are actually on the way back up.

There’s an advantage to buying a home now. You’ll buy at a discount from last year’s price and before prices start to pick up even more momentum. It’s called “buying at the bottom,” and that’s a good thing.

Bottom Line

If you have questions about what’s happening with home prices, or if you’re ready to buy before prices climb higher, let’s connect.