The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

Mortgage rates were historically low throughout most of 2020 and 2021 but increased steadily throughout 2022. Now, mortgage rates are roughly twice what they were a year ago as it rose for the 5th time last month.

The 30-year fixed rate mortgage remained at its highest level since last November, increasing by 8 basis points from the prior week on the Federal Reserve's aggressive posture on the economy, Freddie Mac said.

As of Thursday, April 6, 2023, current interest rates in California are 6.73% for a 30-year fixed mortgage and 5.91% for a 15-year fixed mortgage. After hitting record lows in 2021, mortgage rates rose sharply in 2022. Note: Actual rates may vary.

But as we move into the spring buying season, mortgage rates have ticked lower 📉 The drop in mortgage rates we’ve seen in recent weeks is good news for those who have been sitting, waiting and watching the market.

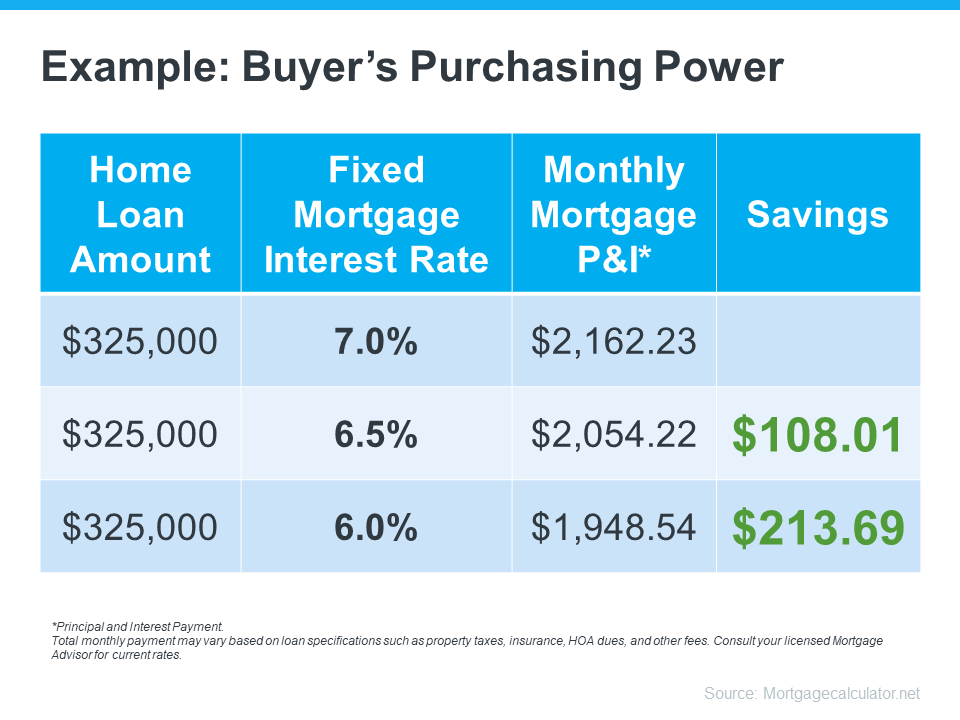

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.

The recent uptick in rates has been driven by what’s happening with inflation. Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.”

The most recent weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%. It’s the third week in a row that rates have increased and puts them at the highest point they’ve been this year (see graph below):

Mortgage Rate Predictions for April 2023

Here’s how other experts predict market conditions will affect the 30-year, fixed-rate mortgage in the coming months:

- Compass U.S. region president, Neda Navab: There have been signals that mortgage interest rates may be at or near their peak, given recent encouraging news around inflationand a corresponding drop in the U.S. Treasury yields that help set mortgage rates. A sustained drop could push mortgage rates into the 5% range late in the second quarter or in the second half of 2023, but that’s definitely not guaranteed.

- Mortgage Bankers Association (MBA): “Long-term rates have already peaked. We expect that 30-year mortgage rates will end 2023 at 5.2%.”

- National Association of Realtors (NAR) senior economist and director of forecasting, Nadia Evangelou: “If inflation continues to slow down—and this is what we expect for 2023—mortgage rates may stabilize below 6% in 2023.”

- Freddie Mac: Forecasts the average 30-year mortgage to start at 6.6% in Q1 2023 and end at 6.2% in Q4 2023.

- Realtor.com economist, Jiayi Xu: “Mortgage rates are likely to move in the 6% to 7% range over the next few weeks, which continues to pose a significant challenge to affordability.”

- Zillow Home Loans senior macroeconomist, Orphe Divounguy: “A fight over raising the debt ceiling is likely to drag into the summer, and mortgage borrowers should expect rate volatility as a result.”

If you’re thinking about pausing your home search because rates have started to go up again, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. According to the MBA, mortgage applications declined by 13.3% in just one week, so it appears the rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, what does that mean for you? If you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

Bottom Line

Over the last few weeks, mortgage rates have risen. But that doesn’t mean you should delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. Let’s connect today to explore the options in our local market.

SOURCES: https://www.rismedia.com/2023/02/23/mortgage-rates-continue-uptick/,

https://www.rismedia.com/2023/03/02/mortgage-rates-continue-climb-up/,

https://www.mykcm.com/2023/02/28/what-you-should-know-about-rising-mortgage-rates/

https://www.bankrate.com/mortgages/analysis/

https://www.nationalmortgagenews.com/news/mortgage-rates-continue-their-climb

https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

https://www.centredaily.com/news/nation-world/national/article273074900.html