Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions:

1. Why Are Mortgage Rates So High?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

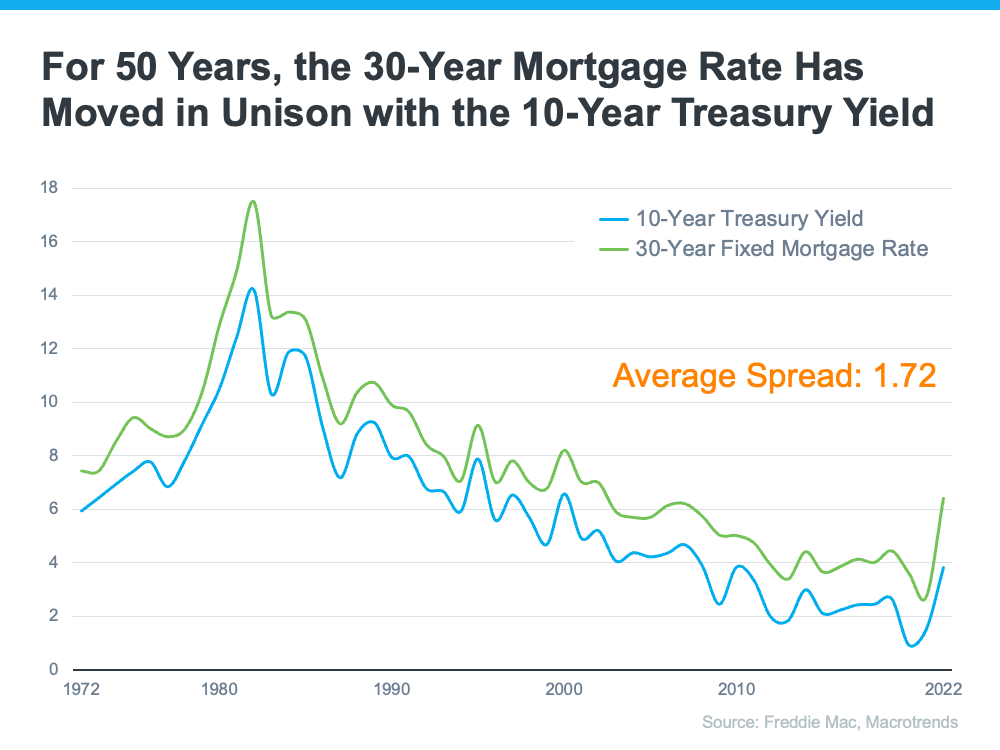

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

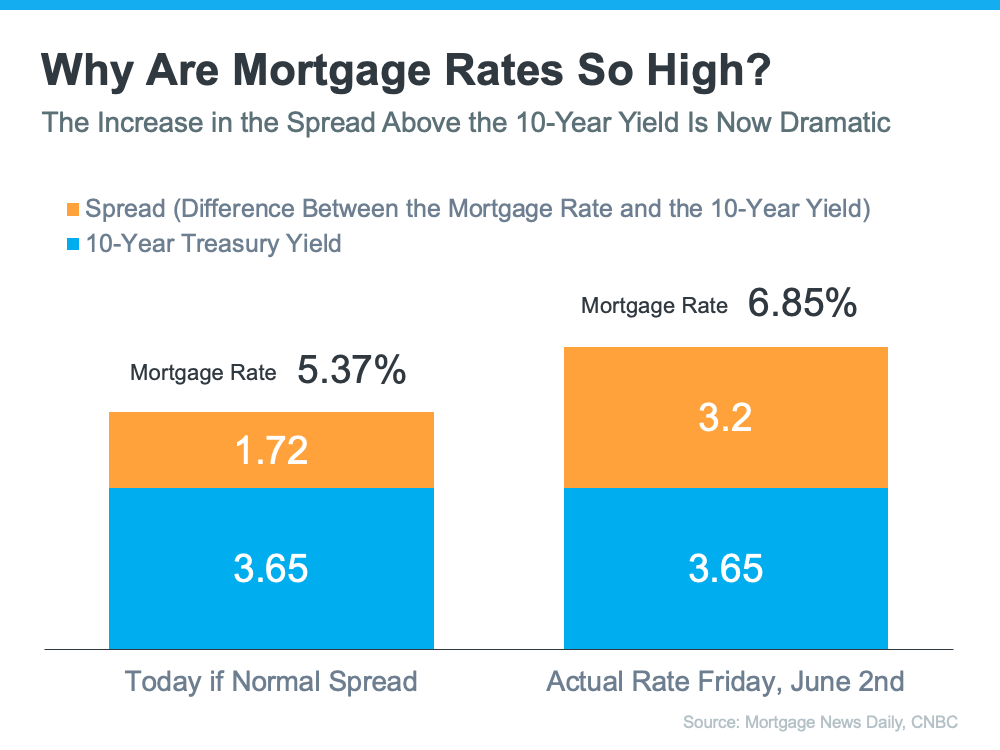

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09."

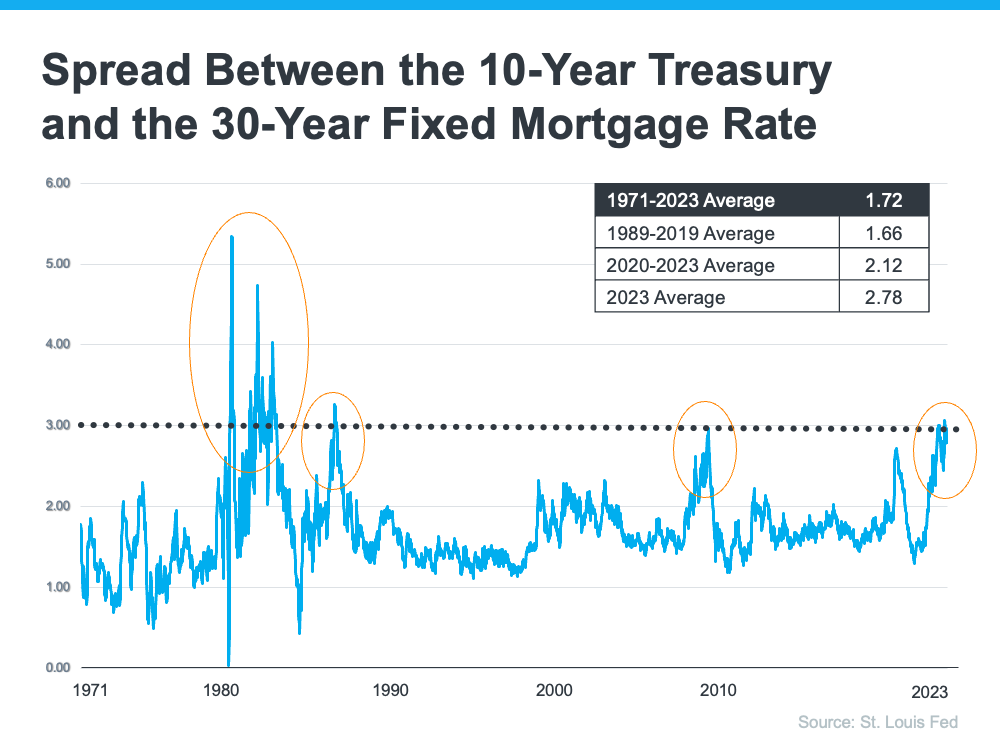

The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

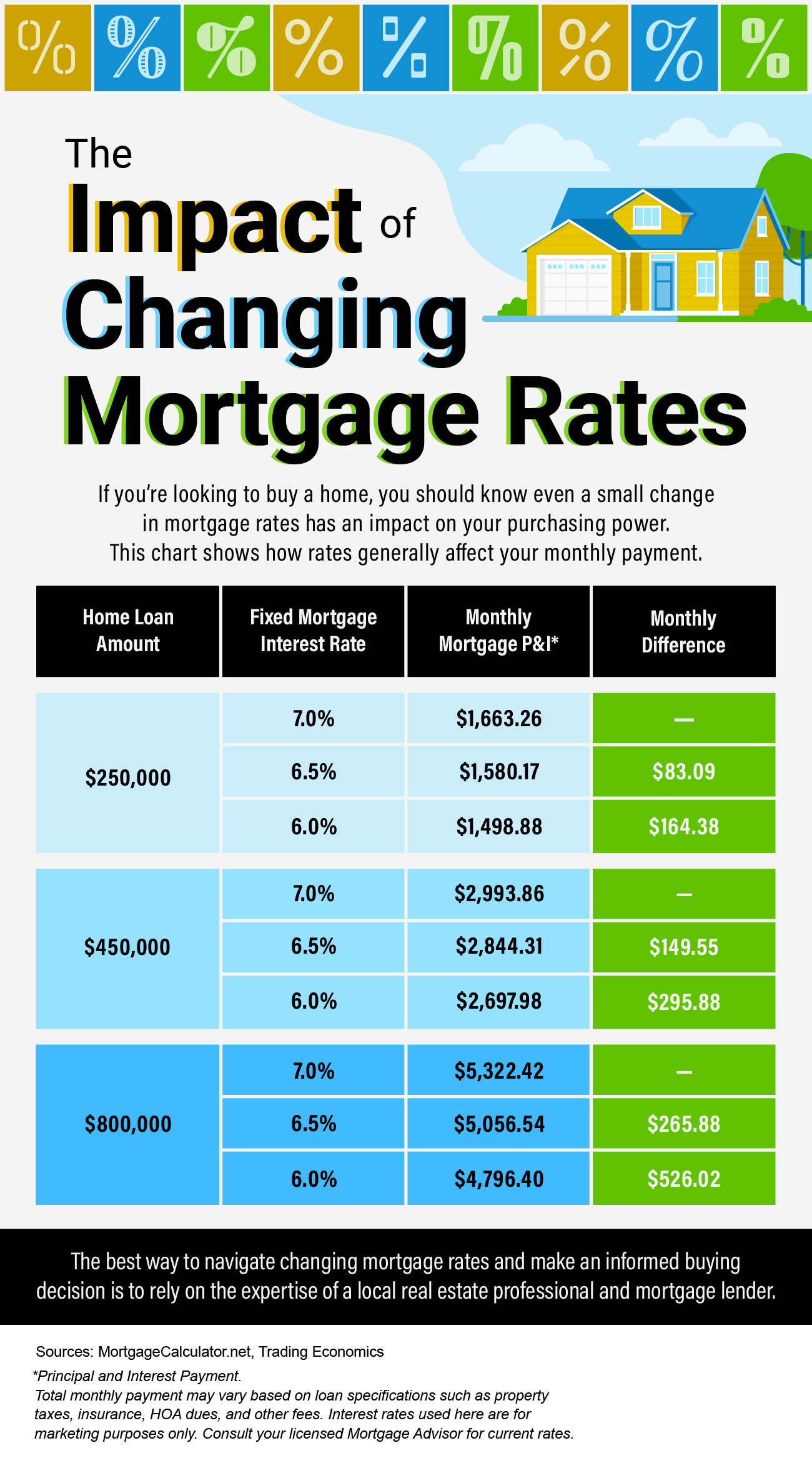

If you’re looking to buy a home, you should know even a small change in mortgage rates has an impact on your purchasing power. These charts show how rates generally affect your monthly payment. The best way to navigate changing mortgage rates and make an informed buying decision is to rely on the expertise of a realtior and mortgage lender.

The Impact of Inflation on Mortgage Rates

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know.

Inflation and the Housing Market

While the Fed’s working hard to lower inflation, the latest data shows that, while the number has improved some, the inflation rate is still higher than the target (2%). That played a role in the Fed's decision to raise the Federal Funds Rate last week. As Bankrate explains:

“Keeping its inflation-fighting streak alive, the Federal Reserve has raised interest rates for the 10th time in 10 meetings . . . The hikes aimed to cool an economy that was on fire after rebounding from the coronavirus recession of 2020.”

While the Fed’s actions don’t directly dictate what happens with mortgage rates, their decisions do have an impact and contributed to the intentional cooldown in the housing market last year.

- How This Impacts You

During times of high inflation, your everyday expenses go up. That means you’ve likely felt the pinch at the gas pump and in the grocery store. By raising the Federal Funds Rate, the Fed is actively trying to lower inflation. If the Fed is successful, it could also ultimately lead to lower mortgage rates and better homebuying affordability for you. That’s because when inflation is high, mortgage rates tend to be high. But, as inflation cools, experts say mortgage rates will likely fall.

Where Experts Think Mortgage Rates and Inflation Will Go from Here

Moving forward, both inflation and mortgage rates will continue to impact the housing market. And as Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Mortgage rates are likely to descend lower later in the year as the consumer price inflation calms down . . .”

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:

“We continue to expect that mortgage rates will drift down over the course of the year as the economy slows . . .”

While there’s no way to say with certainty where mortgage rates will go from here, the experts think mortgage rates will trend down this year if inflation comes down too. To stay informed on the latest insights, connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting and how it could impact your homeownership plans.

Buyer Activity Is Up Despite Higher Mortgage Rates

If you’re a homeowner thinking about making a move, you may wonder if it’s still a good time to sell your house. Here’s the good news. Even with higher mortgage rates, buyer traffic is actually picking up speed.

Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has increased in recent months (see graph below):

As the graph shows, the first two months of 2023 saw a noticeable increase in buyer traffic. That’s likely because the limited number of homes for sale kept shoppers looking for homes even during colder months.

To help tell the story of why the latest report is significant, let’s compare foot traffic this February with each February for the last six years (see graph below). It shows this was one of the best Februarys for buyer activity we’ve seen in recent memory.

In the last six years, we saw the most February buyer traffic in 2021 and 2022 (shown in green above), but those years were highly unusual for the housing market. So, if we compare February 2023 with the more normal, pre-pandemic years, data shows this year still marks a clear rise in buyer activity.

The uptick in buyer traffic is even more noteworthy considering the increase in mortgage rates this February. The Freddie Mac 30-year fixed mortgage rate rose from 6.09% during the week of February 2nd to 6.50% in the week of February 23rd. But even with higher rates, more buyers were looking for a home.

Jeff Tucker, Senior Economist at Zillow, says the increased buyer activity could continue:

“More buyers will keep coming out of the woodwork. We always see a seasonal uptick in home shoppers in March and April . . .”

If you’re looking to sell your house, seeing buyers still active in the market this year should be encouraging. It’s a sign buyers are out there and could be looking for a home just like yours. Working with a real estate professional to list your house now will help you get your home in front of eager buyers today.

Remember, Your Needs Matter More Than Today’s Mortgage Rates

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place.

It’s true mortgage rates have climbed from the record lows we saw in recent years, and that has an impact on affordability. With rates where they are right now, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home. As Danielle Hale, Chief Economist at Realtor.com, explains:

“. . . homeowners who locked in a 30-year fixed rate in the 2-3% range don't necessarily want to give that up in exchange for a rate in the 6-7% range.”

But your lifestyle and your changing needs should matter more. Here are a few of the most common reasons people choose to sell today. Any one of these may be more important than keeping your current mortgage rate.

As Ali Wolf, Chief Economist at Zonda, says in a recent tweet:

“First-time and move-up buyers are both active . . . the latter driven by life changes. Divorce, marriage, new higher paid job, and existing home unsuitable all referenced.”

- Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in a dream location, or just looking for a change in scenery.

For example, if you live in suburbia and just landed your dream job in NYC, you may be thinking about selling your current home and moving to the city for work.

- Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and decide it’s time to seek out a home with more space, or if your household is growing, it may be time to find a home that better fits those needs.

- Downsizing

With inflation driving up everyday expenses, homeowners may also decide to sell to reduce maintenance and costs. Or, they may sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move to somewhere you can enjoy the warm weather and have less house to maintain. Your new lifestyle may be better suited for a different home.

- Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell to buy different homes.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and downsizing may be better options.

- Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their current home to find one that works better for them.

For example, you may be looking to sell your home and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal decision. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you’re ready to sell your house so you can make a move, Rising foot traffic is a bright spot for this year’s housing market and indicates that buyers are looking to purchase this year, even with higher mortgage rates.

Don’t let headlines about the latest decision from the Fed confuse you. Where mortgage rates go from here depends on what happens with inflation. If inflation cools, mortgage rates should tick down as a result. Let’s connect so you have expert insights on housing market changes and what they mean for you.

Let’s connect so you have an expert on your side to help you navigate the process and find a home that can deliver on what you’re looking for.