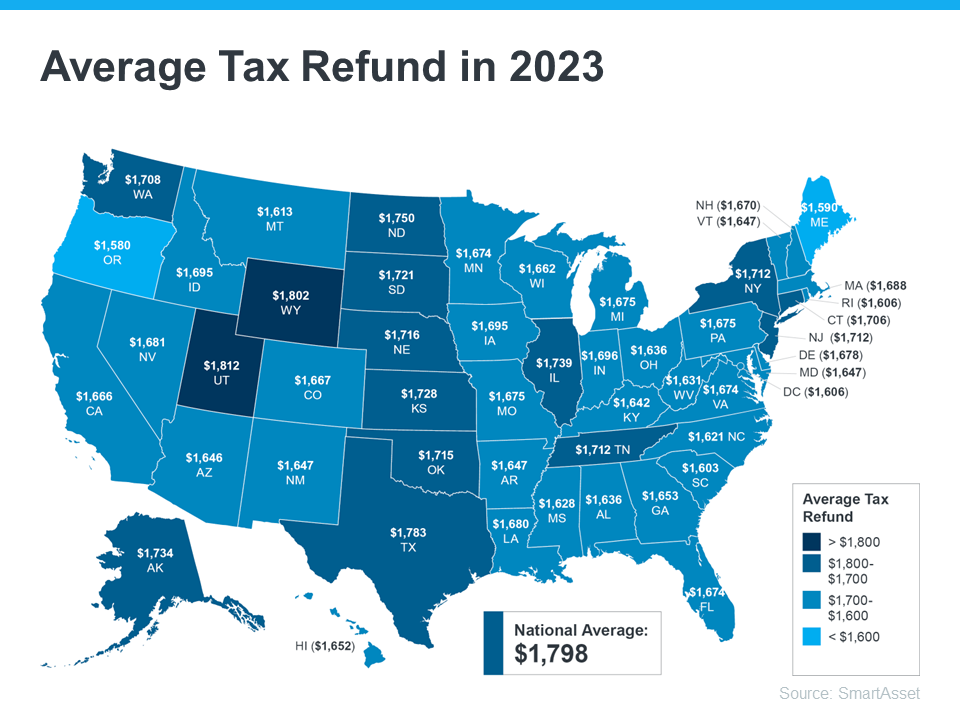

Have you been saving up to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve your goals by paying for some of these expenses.

SmartAsset estimates the average American will receive a $1,798 tax refund this year. The map below provides a more detailed estimate by state:

According to Freddie Mac, there are multiple ways your refund check can help you as a homebuyer. If you’re getting a refund this year and thinking about buying a home, here are a few tips to keep:

-

Saving for a down payment

One of the largest barriers to homeownership is saving for a down payment. You could reach your savings goal more quickly than expected by using your tax refund to help with your down payment.

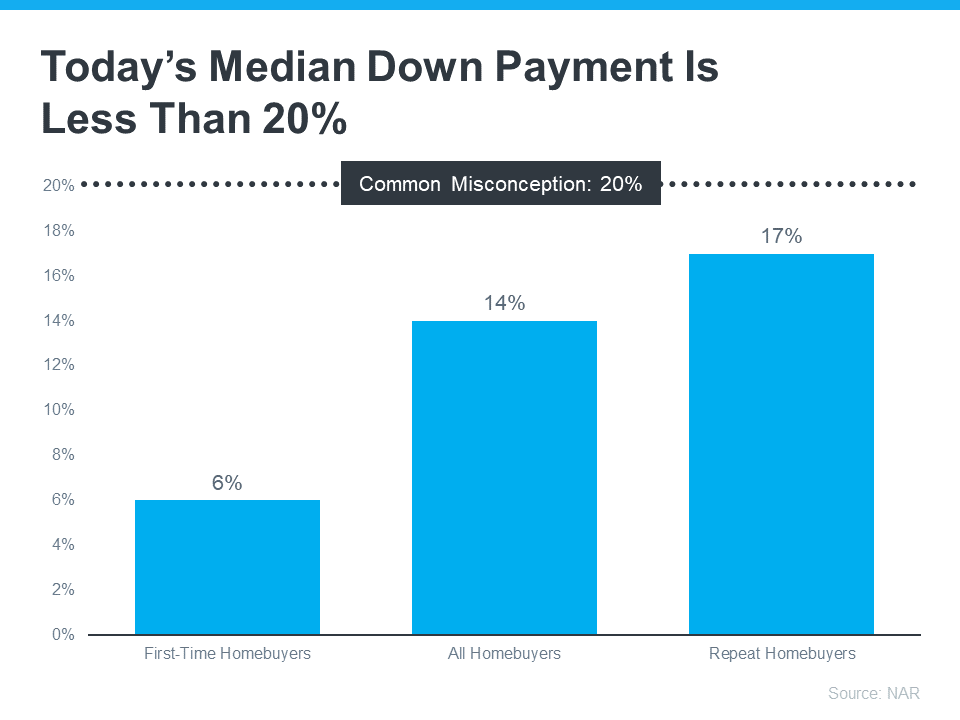

Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%. Let’s connect to make sure you have a trusted lender and can find out if you’re ready to buy a home sooner rather than later.

If you’re getting ready to buy your first home, you’re likely focused on saving up for everything that purchase involves. One cost that’s likely top of mind is your down payment. But don't let a common misconception about how much you need to save make the process harder than it could be.

Understand 20% Isn’t Always the Typical Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize. According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, the median down payment today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

Learn About Options That Can Help You Toward Your Goal

If saving for a down payment still feels like a challenge, know that there’s help available. A real estate professional and trusted lender can show you options that could help you get closer to your down payment goal. According to latest Homeownership Program Index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. Plus there are even loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. To understand your options, be sure to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your down payment options.

-

Paying for closing costs

You have to pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before you can officially take ownership of your home. You could direct your tax refund toward these closing costs.

Typically, homebuyers will pay between 2% and 5% of the purchase price of their home in closing costs, or between $4,000 and $10,000 on a $200,000 home. Closing costs will vary depending on where you live, so be sure to review your situation to fully understand your costs.

- Lowering your interest rate

Your lender might give you the option to buy down your mortgage interest rate during the home buying process. That means, you could pay upfront to have a lower interest rate on your fixed-rate mortgage.

During the homebuying process, some lender may present you the option to pay discount points to buy down your mortgage interest rate. A "point" equals 1% of the loan. Discount points are’ essentially an upfront interest payment to lock in a lower interest rate on your fixed-rate mortgage, ultimately saving you money over the life of your loan. Using your tax refund to pay discount points can help lower the amount of your monthly mortgage payments.

The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey.

Bottom Line

Your tax refund can help you reach your goals of homeownership. Let’s connect to discuss how you can start your journey today and If you want to purchase a home this year, let’s connect so we can start preparing!

SOURCES: https://myhome.freddiemac.com/blog/homebuying/how-use-your-tax-refund-buy-home, https://smartasset.com/data-studies/states-with-the-largest-tax-refunds-2023

![You May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC] | Simplifying The Market](https://api.simplifyingthemarket.com/wp-content/uploads/2023/02/You-May-Not-Need-As-Much-As-You-Think-For-Your-Down-Payment-MEM.png)